Hubbard Wind Farm receives Tax Abatement

After a large showing of support for the Hubbard Wind Farm Project during a public hearing Tuesday, Sept. 8, Limestone County Commissioners voted unanimously during their following meeting to create a reinvestment zone and adopt a tax abatement agreement with Hubbard Wind LLC.

Precinct 1 Commissioner John McCarver was not in attendance.

“I’ve received probably 100-plus positive emails and letters and statements in support of this, and I have yet to have one person tell me ‘no I don’t want this,’” County Judge Richard Duncan said. “It sounds like the people that are involved are excited about this, not to mention what Coolidge ISD is thinking about it; it’ll be a real shot in the arm for them.”

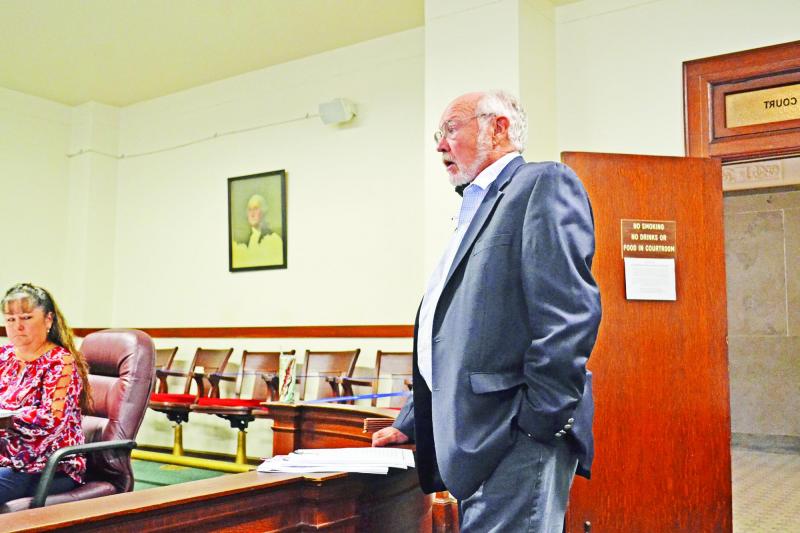

County Attorney Bob Bass provided those in attendance with a refresher overview of the project and the abatement terms. The 300 megawatt project falls about 60% in Hill County and 40% in Limestone county, and in exchange for the 100% tax abatement, Hubbard Wind Farm will provide an annual “Payment In Lieu Of Tax” (PILOT) in the amount of $340,000 for the first 10 years of the project, which equates to about a 70% tax abatement. A road-use agreement was also outlined stating that Hubbard Wind LLC would leave the roads in the same or better condition than they found them once completion of the project was achieved.

Brittany Bruce, a representative for NextEra Wind Energy explained the timeline for the project, with plans in place for surveying and research to begin in December of this year, and construction to begin and be completed in 2021.

Several people sat in for the public hearing, but only a few took the opportunity to speak before commissioners voted on the tax abatement.

“My name is Jodie Foster and I’m a landowner in the northern part of Limestone County. I’m very proud of my land and I’ve done a lot of work on it to get it in good shape. We’ve researched these wind farms a little bit; been to the one in Axtell and Marlin, and I’ve never heard anything negative from anyone. I’ve talked with some of the workers and it’s a win-win situation all the way around to me. It’s very clean energy, it’s going to help the community and jobs and everything else. I don’t see anything negative about it one bit whatsoever, and we’re proud that it’s coming in. I hope it does and the court smiles on the people that are trying to get this work done.”

Foster’s wife, Margo, also spoke, representing the Hubbard Chamber of Commerce and speaking in support of the project. “We have a Hubbard address but live in Limestone County, and we’re in an area where we don’t have the gas; we don’t have the oil; we don’t have the gravel; we don’t have the late-night coal; but we do have wind and we’re going to try and capture that on that end of the county if you will let us.”

Bass noted that this project would create between 200 and 300 temporary jobs for the duration of the construction process, and seven permanent jobs once construction is completed, with incentives to relocate into Limestone County for the type of specialized workers required for the positions.

One man in the audience raised concerns with approving a tax abatement at 70% over 10 years for the creation of so few jobs, to which Bass responded that bringing “several hundred million dollars” to the tax base was attractive to the county even though more jobs would not result from the project.

Duncan pointed out that there are several other benefits that are not so clearly identified, but also that Coolidge ISD will get the full tax-dollar benefits from this project. Garrett Peters, a representative for NextEra Wind Energy stated that each of the four school districts within range of the project will receive millions of dollars in the project’s lifetime, with an expected $10 million in the first 10 years, and the county to receive about $11 million over 30 years.

Commissioners unanimously approved both the creation of the reinvestment zone for tax abatement and the tax abatement agreement with Hubbard Wind LLC in what is expected to be a win for Limestone County.